Access flexible funding options designed to support your expansion plans with competitive terms and rapid deployment.

Experience financial solutions built for modern businesses with evolving needs

Minimal paperwork and digital approvals reduce wait times significantly.

Financing tailored to your specific business model and revenue cycles.

Clear, straightforward agreements with no hidden fees or surprises.

Financial products engineered to address your unique business challenges

Specialized programs for construction, manufacturing, and industrial equipment needs.

Financing up to $10M for qualified buyers

Extended terms up to 10 years

Seasonal payment options available

Residual value financing programs

Comprehensive solutions for commercial vehicle acquisitions and fleet upgrades.

New and used vehicle financing

Bulk purchase discounts

Maintenance package options

Fuel efficiency upgrade programs

Specialized financing for medical practices, dental offices, and healthcare facilities.

FDA-approved equipment financing

Technology upgrade cycles

Practice expansion solutions

Compliance-focused financing

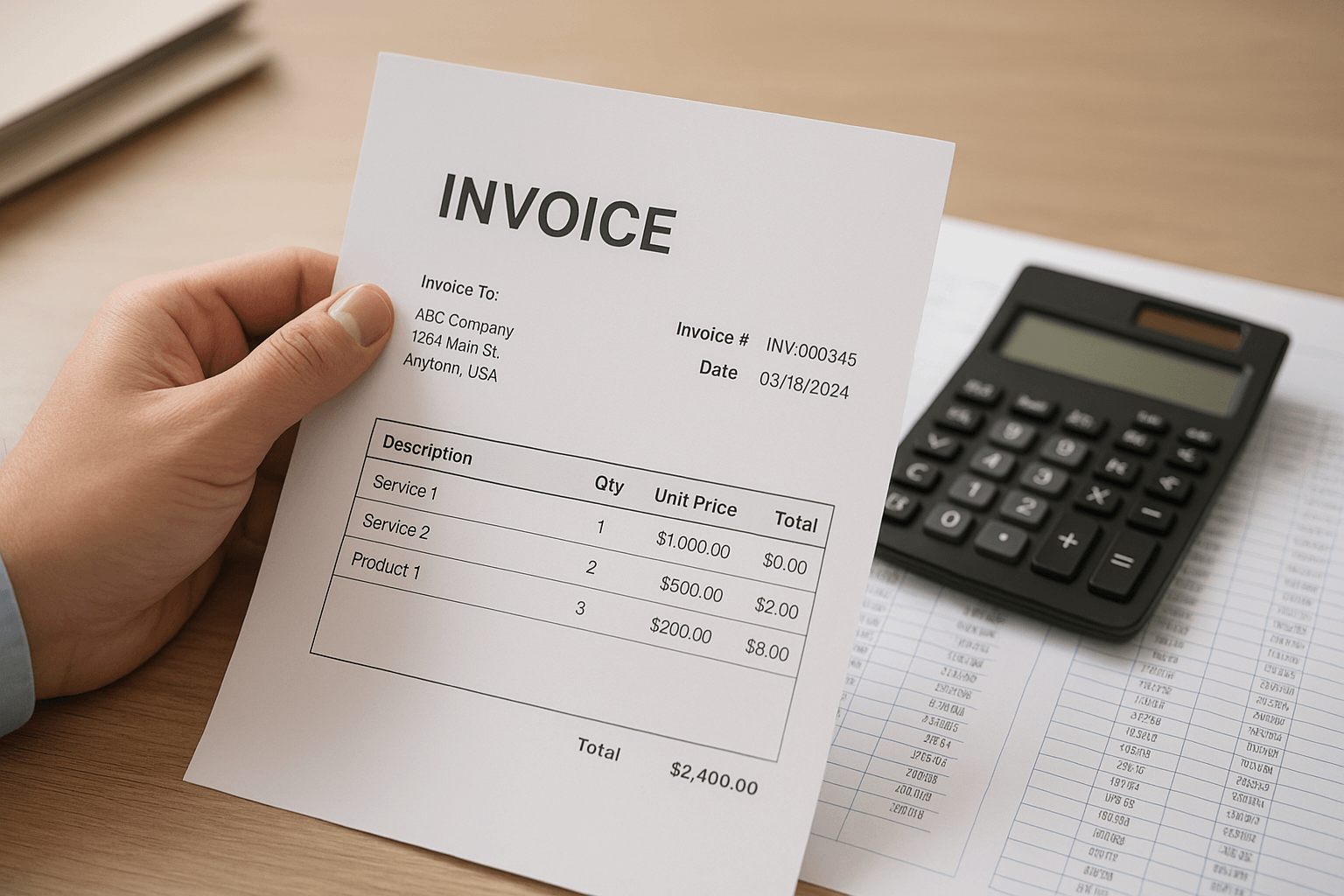

Unlock cash tied up in unpaid invoices without waiting for payment terms.

Up to 90% of invoice value advanced

Credit protection options available

No long-term contracts

Selective invoice funding

Bridge cash flow gaps and maintain operations during growth periods.

Flexible repayment terms

Quick access to funds

No collateral required

Renewable credit lines

Secure funding to fulfill large orders and take on new business opportunities.

Fund supplier payments directly

Scale with your order book

Creditworthy buyer focus

Inventory management support

Finance your physical growth with customized real estate solutions.

Commercial property acquisition

Construction financing

Renovation and build-out

Equipment and facility packages

Capital to support geographic growth and new market penetration.

International trade financing

Distribution network funding

Multi-location support

Regulatory compliance assistance

Strategic capital for business acquisitions and mergers.

Competitor buyout programs

Vertical integration funding

Succession planning solutions

Seller note programs

Flexible access to capital that replenishes as you pay it down.

Draw funds as needed

Interest only on used amounts

Annual renewals

Increasing limits as you grow

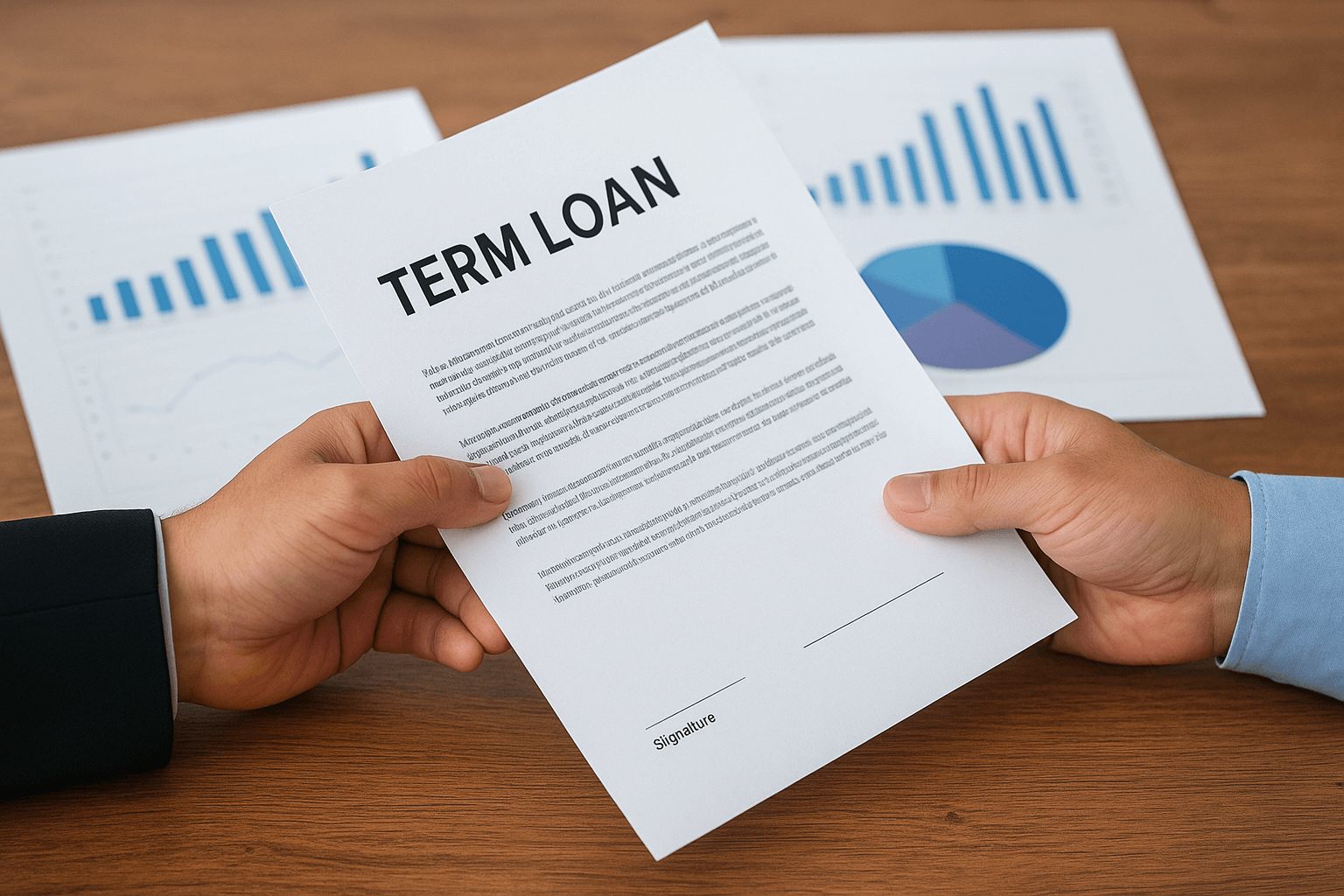

Structured financing with predictable repayment schedules.

Fixed or variable rates

Amortization options

Balloon payment structures

Prepayment flexibility

Leverage your company's assets to secure larger credit facilities.

Accounts receivable financing

Inventory collateralization

Equipment and real estate

Seasonal advance rates

Key advantages that set our financing solutions apart

| Benefit | Traditional Lenders | ProcurePay |

|---|---|---|

| Application Process | Weeks of paperwork | Digital application (minutes) |

| Approval Timeline | 4-6 weeks | As fast as 24 hours |

| Credit Requirements | Strict minimums | Flexible evaluation |

| Payment Flexibility | Fixed schedules | Seasonal/custom options |

| Technology Integration | Manual processes | API connectivity |

Our efficient process gets capital flowing to your business quickly

We analyze your financial requirements and business objectives

Our experts create a customized financing package

Secure digital submission of required information

Rapid transfer of capital to your business account

Connect with our financing specialists to explore your options today.

Request Financing