Optimize your asset portfolio with data-driven investment strategies

Transform fixed assets into strategic growth drivers

Our proprietary models identify optimal investment timing and asset classes based on your industry cycle and financial position.

Analyze how new investments complement existing assets to maximize operational efficiency and ROI.

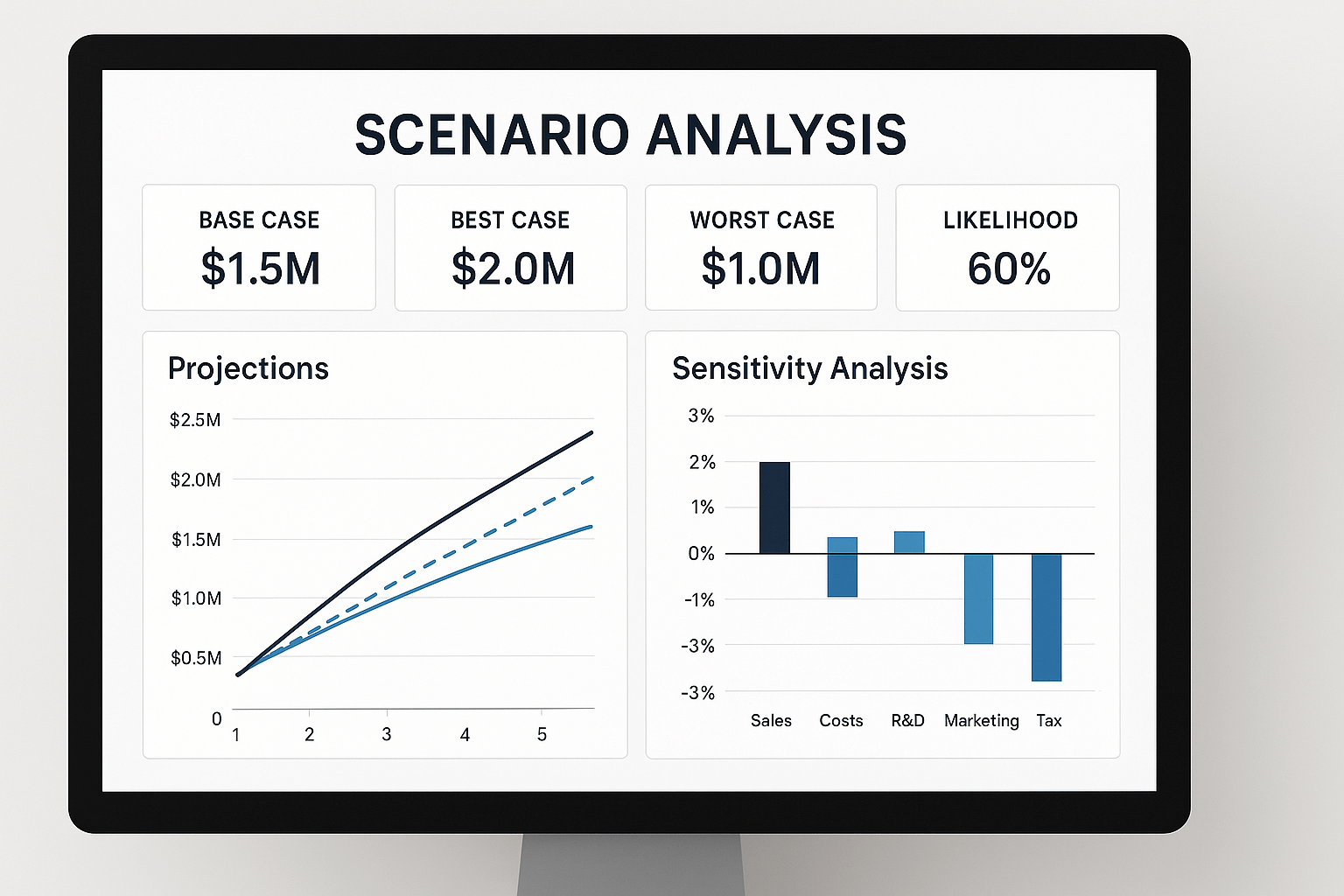

Evaluate investments through multiple scenarios to balance growth objectives with risk tolerance.

A disciplined approach to capital allocation

Map each asset's productive lifespan, maintenance costs, and technological obsolescence risk.

Structure investments to maximize available incentives, credits, and depreciation benefits.

Tailor capital structures to match asset profiles and cash flow characteristics.

Real-world examples of strategic asset optimization

Staggered equipment upgrades synchronized with product lifecycle, reducing downtime while qualifying for R&D tax credits.

Right-sized imaging equipment mix across 12 locations using utilization data and predictive maintenance schedules.

Data-driven decision support for capital planning

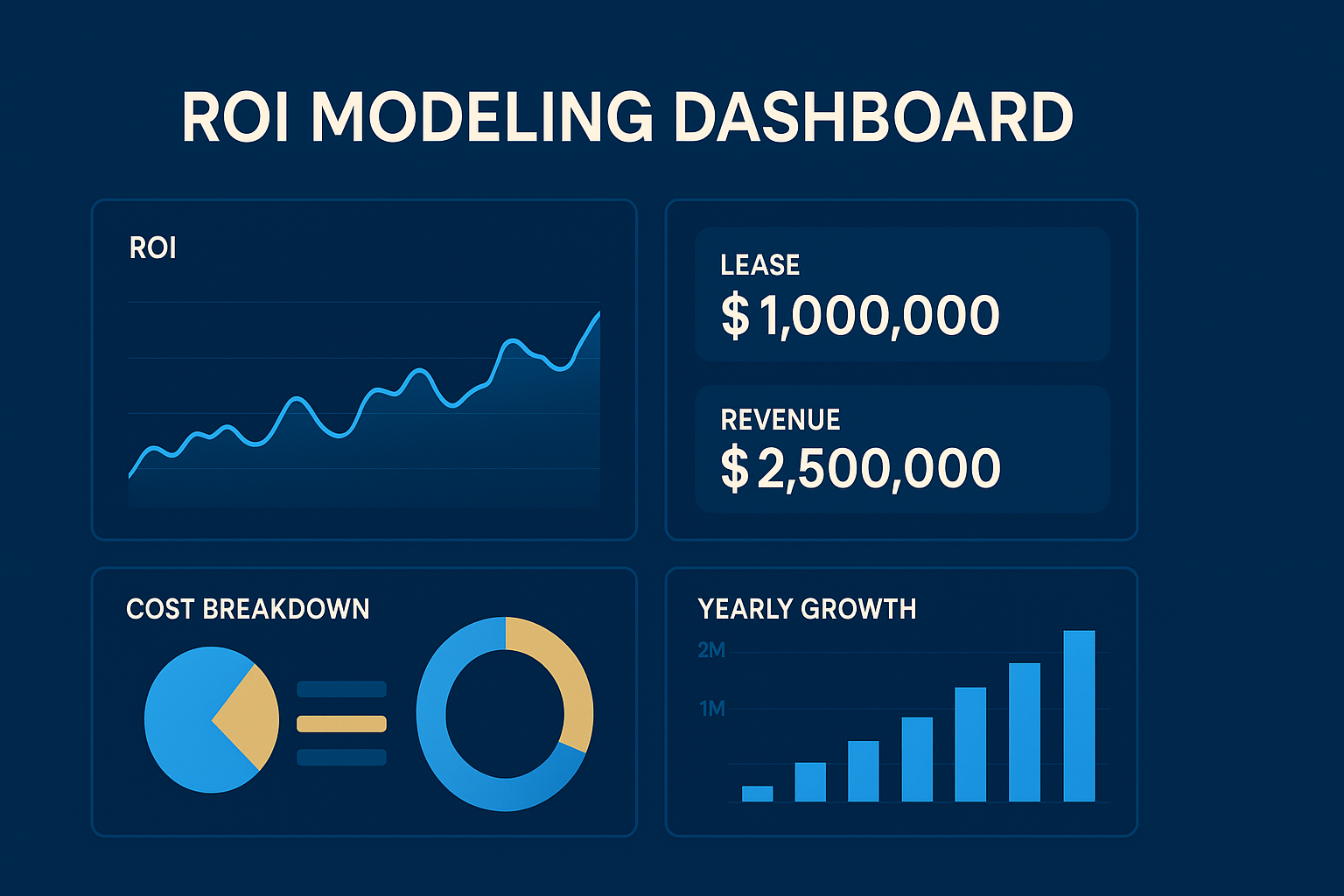

Our interactive tool evaluates multiple financial metrics across your investment horizon:

Evaluate capital investments under different economic and operational conditions:

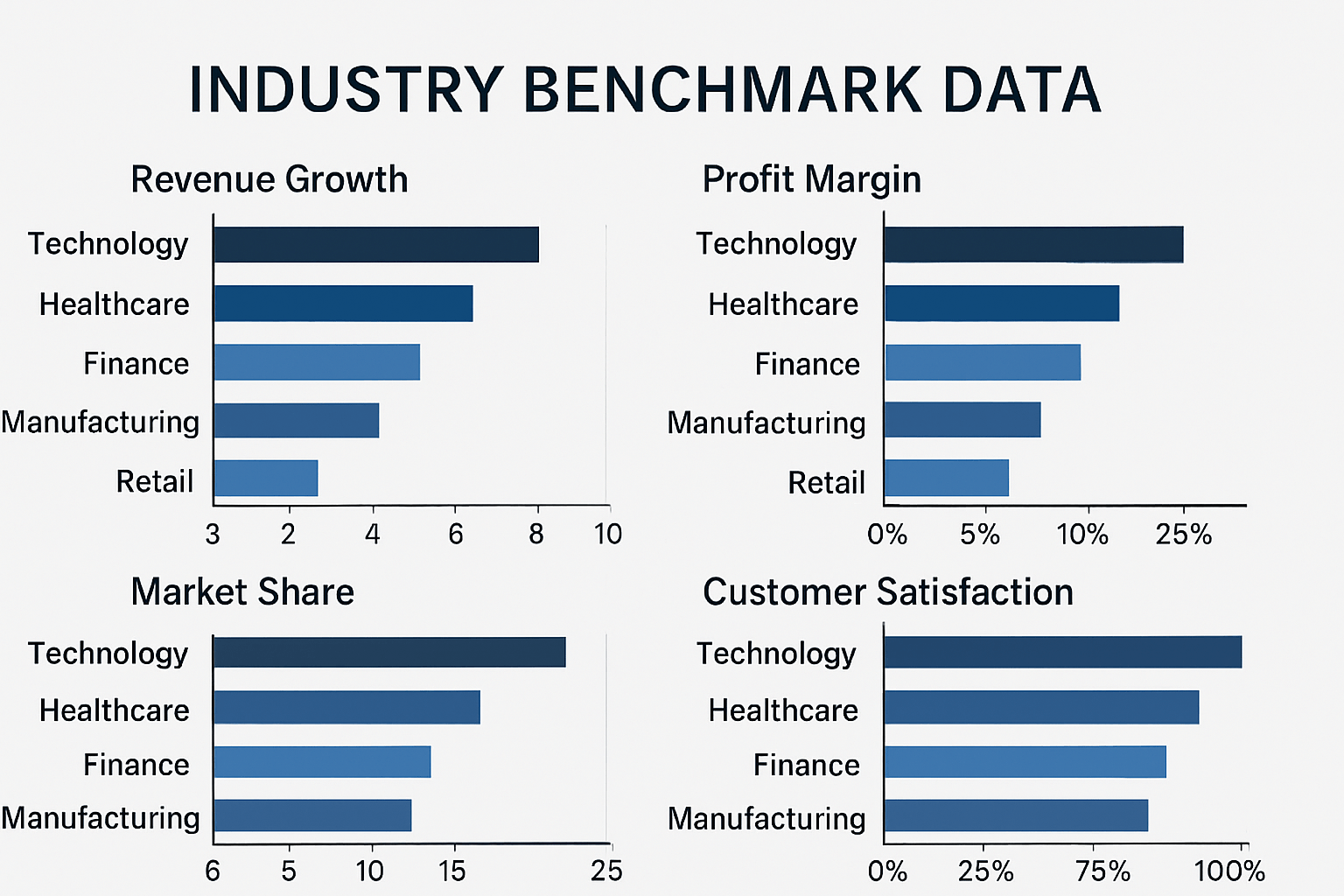

Compare your capital performance against industry standards:

Our financial engineers will analyze your asset portfolio and recommend data-driven investment strategies.

Consult Our Experts